Behavioural biases and the approach of EVIDENT

Behavioural biases have a significant impact on people’s decision-making process. This is mostly due to consumers’ inclination to rely on shortcuts due to time restrictions and cognitive ability to digest a huge amount of information. Numerous studies suggest that biases such as base rate fallacy, present bias, anchoring bias, and others have a considerable and predictive influence on financial markets and everyday economic decisions. Especially in the energy sector, these biases may influence the decision to invest or not in more energy-efficient appliances. Because of the high upfront costs of these investments and the long-term savings for consumers, temporal individual preferences and biases influence the desire to invest in energy efficiency improvements, ultimately leading to underinvestment or less-than-optimal choices.

The EVIDENT project aims to consolidate all factors that influence consumers’ behaviour for a better understanding of the energy efficiency gap and for proposing specific policy actions. In this direction, EVIDENT will carry out a quasi-experiment related to the average pricing bias in order to evaluate how literacy levels and biases are related. For example, marginal pricing can be imposed in specific situations, such as when consumers switch between peak and off-peak consumption periods towards protecting the electricity grid against disruptions. Consequently, several marginal prices for the same service are created, thereby complicating the decision-making process. Despite its importance, this topic has not attracted much research attention, as the consumers’ willingness-to-pay is the focus of most surveys.

Design of Quasi-Experiment

The planned quasi-experiment will be carried out via the EVIDENT platform and will include questions designed to elicit customers’ biases as well as their financial and environmental literacy levels. Finally, the participant will be asked to choose between various pricing schemes that include simple and more complex non-linear energy consumption charges. The aim of the quasi-experiment is to obtain some proxy estimates about the drivers of the observed heterogeneity in customers’ price misperceptions and leverage the findings for specific policy recommendations. The experiment is designed in a way to elicit consumers’ perceptions about different pricing schemes and to relate findings with potential behavioural biases and the participants’ financial and environmental literacy levels. The implementation of the experiment is expected to take place through the EVIDENT’s platform and it is designed as follows:

- 1st step: Participants answer a small set of questions for collecting demographic data.

- 2nd step: Participants answer a small set of questions related to biases.

- 3rd step: Participants answer a small set of questions related to financial literacy.

- 4th step: Participants answer a small set of questions related to environmental literacy.

- 5th step: Participants answer a small set of questions related to price perceptions.

Key cognitive biases in decision making

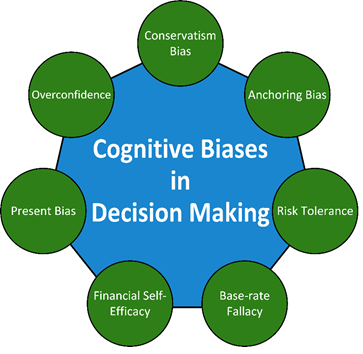

Cognitive biases are systemic flaws in the cognitive process that arise as people process and interpret information from their surroundings, influencing their decisions and judgments. Thus, cognitive biases are crucial elements in decision-making and, when combined with low levels of financial literacy, can lead to irrationality during the financial decision-making process. In this respect, seven key cognitive biases in the decision-making process have been identified, as shown in the Figure.

Overconfidence is effectively described as the tendency to overestimate the likelihood of attaining a goal due to the self-righteous assumption that one’s abilities or qualities may be exploited to achieve a specific result.

Conservatism bias is a mental process in which people insist on their past views or impressions even when confronted with contrary facts. This suggests that the conservatism bias encourages individuals to overestimate historical rates while underestimating new evidence. As a result, when new knowledge arrives, people are unable to respond rationally and promptly.

Anchoring bias is the tendency of people to overestimate the likelihood of an uncertain event or to forecast or recall a specific value or result by evaluating the original value and shifting it up or down to make conclusions. Anchoring is a psychological bias that influences how people estimate and interpret probabilities.

Risk tolerance is defined as the level of risk exposure with which an individual is comfortable, or as an estimate of the level of risk an investor is willing to tolerate in his or her investment portfolio, and it is an important factor in financial planning. Furthermore, risk tolerance is linked to other cognitive biases such as overconfidence, the base rate fallacy, and conservatism.

The base-rate fallacy is associated with people’s current assumptions, which influence their judgment and perception of probabilities even when the expected results appear to be statistically inaccurate. When new information is obtained, “rational” investors update those probabilities to reflect the new information; but, when subjected to the base rate fallacy, only a little attention is given to the base rates, whereas too much attention is given to the new information.

Financial self-efficacy is linked to self-confidence, motivation, and optimism that one can overcome a variety of challenges. It also refers to a sense of personal agency and the belief that one can accomplish and succeed in a certain task. Self-efficacy, for example, may influence a person’s perceptions about their ability to influence situations, overcome obstacles, and make decisions.

The present bias refers to the tendency of people to prefer a smaller reward that is closer to the present time rather than a greater later reward. Impatience or the desire for immediate gratification in decision-making are terms that are frequently used to describe the concept of present bias more widely.

Evaluation of financial literacy

Every day, consumers are confronted with a plethora of choices, ranging from product and service selection to savings management. Financial literacy has been defined as a combination of human capital investment and cognitive competence associated with financial decision-making. In short, financial literacy refers to the information and abilities necessary to make sound financial decisions. As a result, it has the potential to significantly reduce the cost of energy-efficiency projects.

The EVIDENT financial literacy assessment questionnaire-based toolkit consists of 19 items organised into 7 logical phases, namely self-assessment, financial knowledge, technology knowledge, self-management, present bias, risk and overconfidence, and 3 categories, namely knowledge and skills, attitude and behaviour, and behavioural biases. In addition, the questionnaire consists of seven phases.

- In the 1st phase, each participant has to self-evaluate their financial knowledge. This self-evaluation will be used as a proxy to compare the participants’ answers with the answers to more objective measures to determine the participants’ financial literacy level.

- In the 2nd phase, the questions will measure the four fundamental concepts for financial decision-making: basic numeracy, interest compounding, inflation, and risk diversification. These questions will be used to objectively measure participants’ financial literacy levels.

- In the 3rd phase, questions regarding the knowledge of technology will be used to elicit participants’ technological literacy levels. It is expected that technology knowledge combined with financial knowledge has a crucial role in people’s decision-making process.

- The 4th phase consists of questions related to self-management in order to obtain information about the participants’ attitudes and behaviours and generate a financial background overview.

Finally, the next three phases are focused on behavioural biases and specifically on present bias (5th phase), risk tolerance (6th phase), and overconfidence (7th phase).

Evaluation of environmental literacy

Environmental literacy is defined as an individual’s understanding of how human behaviour affects the environment, as well as the activities required to mitigate these impacts. It is a measure of a person’s understanding of human-environment relationships, environmental challenges, and the numerous links in ecological systems. While there is no universally recognised evaluation approach for environmental literacy, five main metrics, namely Awareness, Knowledge, Attitude, Skills, and Action (AKASA), are widely used in the literature. In the context of the EVIDENT project, an adapted 50-item survey was developed based on the AKASA model. Furthermore, three additional aspects of attitude are included in the survey, namely behavioural intention, values, and general attitude towards the environment.

Please refer to D1.2 Assessing Behavioural Biases and Financial Literacy for more detailed information on the design of the quasi-experiment, along with questionnaire samples.

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No